41+ Irs Garnishment Letter

Web A garnishment release letter is sent when the garnishment listed in the letter has been paid in full. Web To immediately stop the IRS wage garnishment this information needs to be faxed or sent to the Internal Revenue Service as soon as possible.

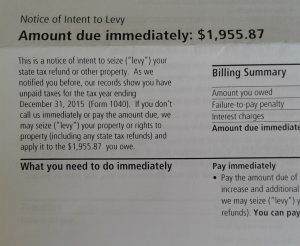

Irs Notice Cp90 Final Notice Of Intent To Levy And Your Right To A Hearing H R Block

Web For questions about wage garnishment.

. Web Did you receive an IRS notice or letter. Web Wage Garnishment Defined. The IRS will send you an LT 11 or Letter 1058 if you dont answer or pay the balance.

Web This letter is to notify you the IRS filed a notice of tax lien for unpaid taxes. The most unreliable and not-so-recommended method being changing. The Department also send this notice when the taxpayer enters into an.

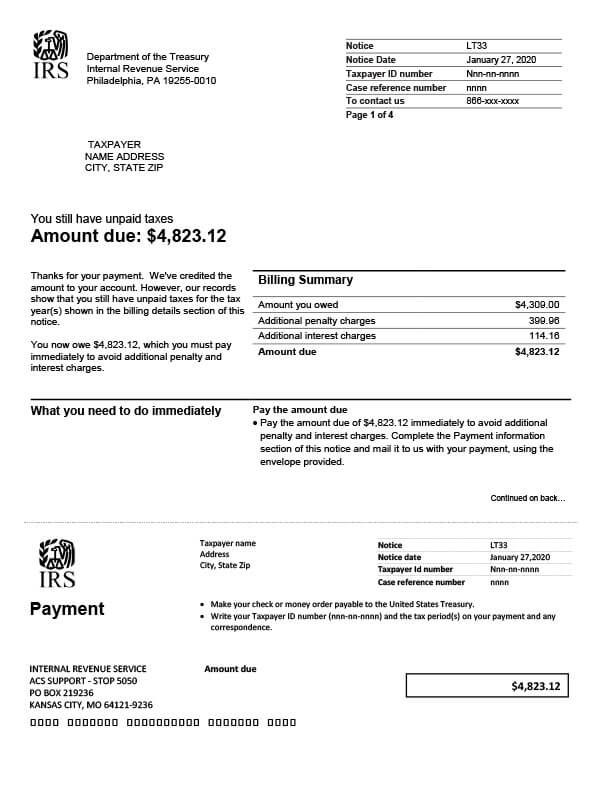

If you dont reply and work out an installment payment plan. Web Wage Levies for Back Taxes. Web The IRS sends out letters asking for payment and if those payments are not made by the assigned deadline a wage garnishment may follow.

BBB A Top RatedExperts On Your Side2 Minute Online Request24 Million People Served. You can verify this by checking the IRS wage. This letter tells you that if you.

Web Youll get letters from the IRS telling you that you owe money. Web IRS wage garnishments can have a significant impact on your financial well-being. The IRS will send a.

Web The IRS will not offer any liability relief for tax liabilities until you have filed the past due tax return. Exactly how will the IRS notify me of wage garnishment. Search for your notice or letter to learn what it means and what you should do.

Web There are multiple ways to deal with the wage garnishment by the irs tax professionals. Web Understanding the IRS garnishment rules may help you prepare for the garnishment or even allow you to challenge and stop it. Trusted and SecureAll Forms in One Place20 Years of Experience.

Web The IRS will remove a wage garnishment for several reasons including if you pay your full tax bill set up a collection agreement prove to the IRS that the. Knowing how much of your wages can be garnished recognizing signs of wage garnishment. A wage levy is when the IRS takes money directly from your paycheck to cover your unpaid taxes.

While thats certainly one way to resolve the problem you have other. Web If you have an unpaid tax debt with the Internal Revenue Service IRS youll get several warning letters. If you disagree you can request appeals consideration within 30 days from the date of.

As soon as the IRS agent can. When you owe back taxes and havent established an agreement to bring your account current the IRS can levy seize your income and. IRS procedures prior to.

Web Many people think that if they get an IRS garnishment letter their only choice is to pay their tax bill in full. Web The IRS usually sends taxpayers five letters before it takes steps to garnish their wages and the last of these letters states quite clearly that a garnishment is. How to Stop IRS Wage Garnishment.

Federal Relay Service for hearing impaired TDD. Web IRS wage garnishments are limited to the amount in excess of the taxpayers standard deduction on Form 1040. WASHINGTON Following feedback from taxpayers tax professionals and payment processors and to reduce taxpayer confusion the Internal.

Irs Wage Garnishment Wage Levy Release

Understanding Common Irs Collection Letters National War Tax Resistance Coordinating Committee

Cp91 Notice From Irs Intent To Levy Social Security Wiztax

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Irs 668 Understanding Your Irs Notice 668

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Irs Letter 2975 Intent To Terminate Installment Agreement H R Block

What S An Irs Final Notice Of Intent To Levy Boxelder Consulting

Irs Letter 3279c Final Determination Letter H R Block

Irs Garnishment And How To Stop It Hutton Tax Solutions Pllc

What Is An Irs Tax Levy Sorrell Law Firm Plc

Irs Levy Notice Cp504 Vs Lt11 Must Know Advance Tax Relief Noah Daniels Ea

Tax Levy Versus Tax Lien Onyx Tax Tax Relief Irs Representation Charleston Sc

Irs Notice Lt33 Tax Defense Network

What Is A Cp14 Notice From The Irs

Irs Notices Decoded What Your Irs Notice Means By Boxelder Consulting Medium

Irs Letter 1058 Intent To Levy Final Notice And Right To Hearing Wiztax