Price weighted index formula

Year 1 12823. It is a weighted index based on market capitalization although the index.

Price Weighted Index Return Youtube

Year 0 Base Year 100.

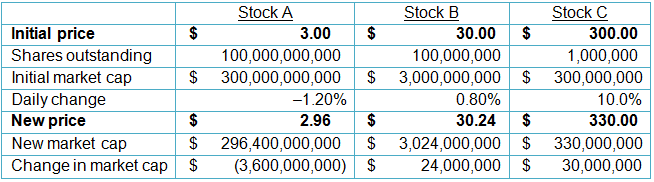

. All you have to do is multiply the price of the stock by the number of outstanding shares. So for example say an index has five stocks. 06012022 Table of Contents.

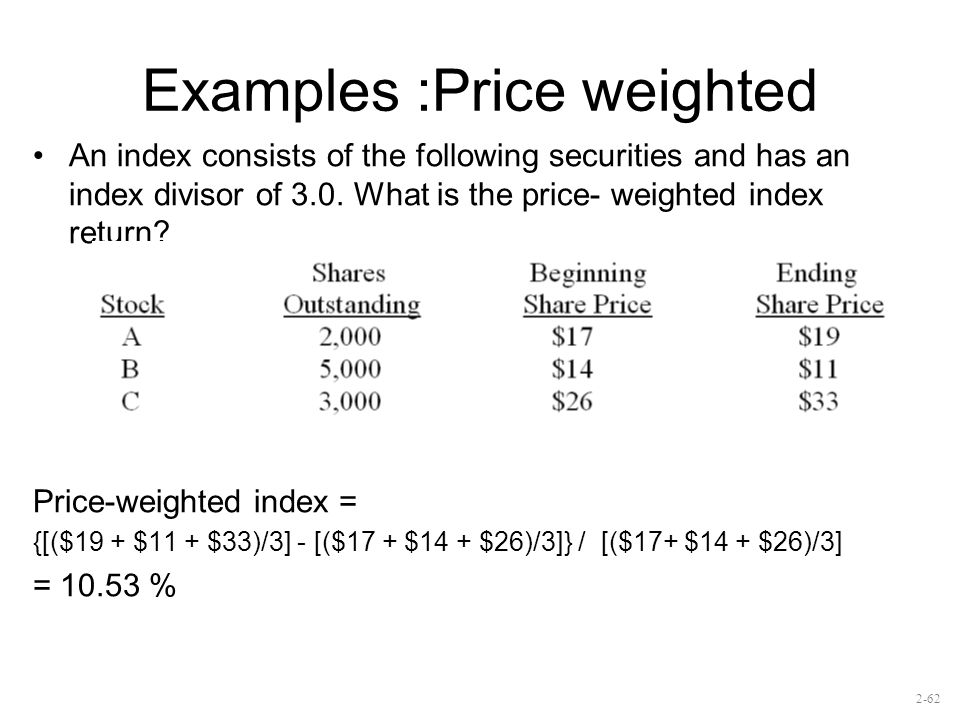

The easiest way to create an index is to divide the sum of all stock prices by 5 and you get a value of 366674. In weighted aggregation weights are assigned to various itemsInstead of obtaining the simple aggregate of price the weighted aggregate of. A number used in the denominator of the ratio between the total value of an index and the index divisor.

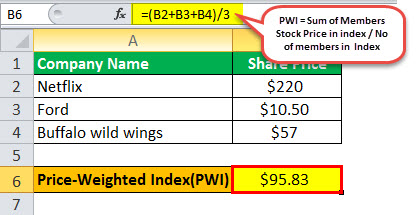

Step 2 Divide the value of all the stocks by the number of stocks in the index to find the value of the index at the start. The sum of all prices is 183337 and there are 5 stocks. The Nasdaq 100 Index is one hundred of the largest companies listed on the Nasdaq exchange.

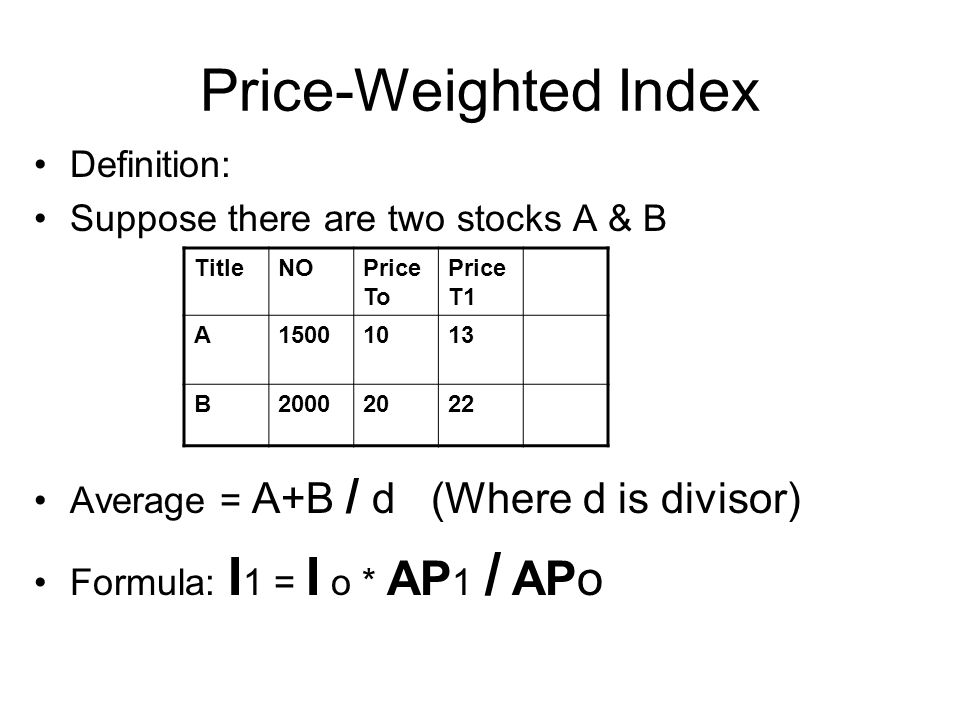

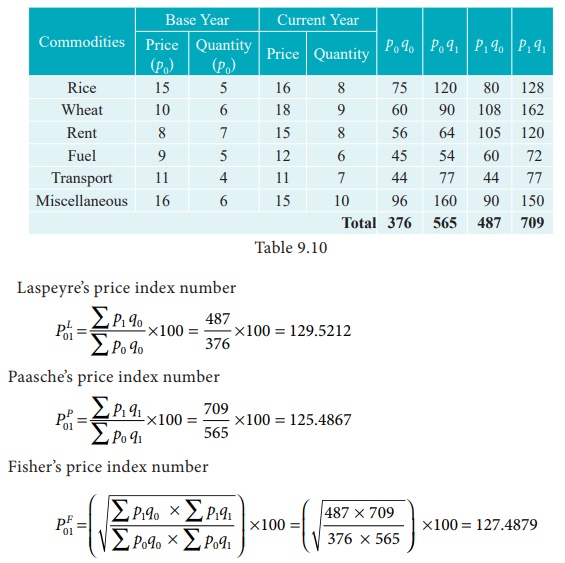

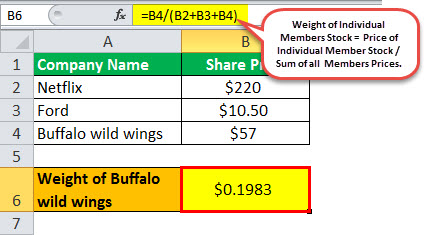

A price-weighted index is simply the sum of the members stock prices divided by the number of members. The formula for calculation of this index in simple terms would be as follows. Price index numbers are usually defined either in terms of actual or hypothetical expenditures expenditure price quantity or as different weighted averages of price relatives.

In this example divide 400 by 4 to find the. Therefore the price indexes were as follows for each year. Thus in our example the XYZ index is.

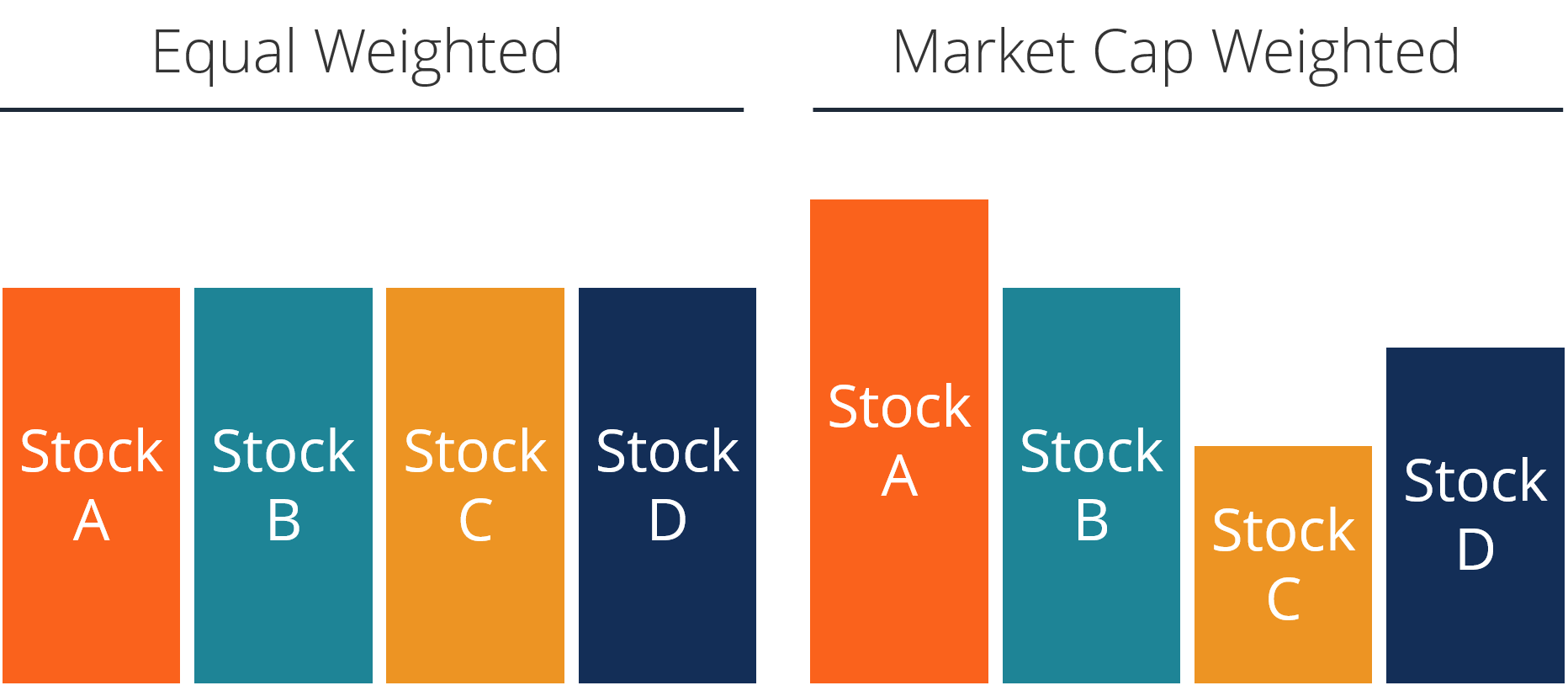

To find equal-weighted index value you would simply add the share price of each stock together then multiply it by the weight. To calculate a price-weighted average or any arithmetic average for that matter simply add the numbers stock prices together and then divide by the number of stocks in the. Value of Equal Weighted Index Price of Stock A Weight Assigned Price of Stock B Weight Assigned.

The number which typically has little mathematical. Using the formula for the Laspeyres Price Index. Year 0 Base Year 100 Year 1 11113 Year 2 12497 Note that in the Paasche Price.

A price-weighted index PWI is a type of stock market index where the weighting of each individual stock within the index is equal to the stock price of each individual. Weighted Aggregate Method. The total value is 400.

Review the value-weighted index formula learn what the rate of return is and see the pros and cons of value-weighted indexes. 4 Suppose stock ABC has six million outstanding shares and trades at 15. 5 7 10 20 1 43 5 86.

Therefore the price index using the Paasche Price Index is as follows for each year.

Stock Market Index Ppt Video Online Download

How To Calculate Price Weighted Stock Market Index

Does It Matter How An Index Is Put Together

Weighted Index Number Definition Solved Example Problems Applied Statistics

Price Weighted Index Formula Examples How To Calculate

Price Weighted Index Formula Examples How To Calculate

Index Calculation Primer Roger J Bos Cfa Senior Index Analyst Standard Poor S Ppt Download

Equally Weighted Index Financial Edge

Equal Weighted Index Definition Advantages And Disadvantages

Price Weighted Index Formula Examples How To Calculate

:max_bytes(150000):strip_icc()/dotdash_Final_Equal_Weight_Apr_2020-01-6b2bdb8ccaf74b8d9170fafe5851d5df.jpg)

Equal Weight Definition

/dotdash_Final_Equal_Weight_Apr_2020-01-6b2bdb8ccaf74b8d9170fafe5851d5df.jpg)

Equal Weight Definition

Introduction To Fundamentally Weighted Index Investing

Introduction To Fundamentally Weighted Index Investing

Simple Index And Weight Index Examples In R

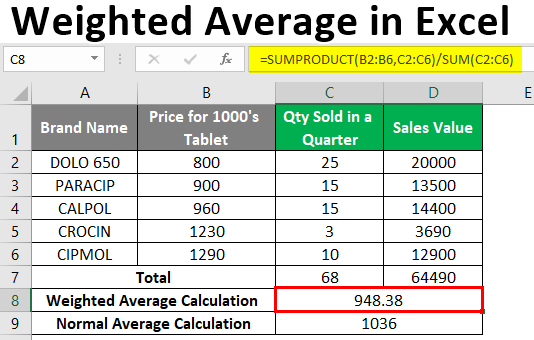

Weighted Average In Excel How To Calculate Weighted Average In Excel

Weighted Aggregate Price Index Mba Lectures